Michael Jackson Impersonator

Do you want to get started investing in crypto?

I have been investing in crypto since 2017. And what I can tell you (from my own experience) is that in order to invest in this industry:

1. You only purchase crypto that you can afford to lose

2. You had another back up income in case the market would close the next day

3. You are patience enough to wait without panic for 5 years

Before diving in, this is the video I just recorded today. In this video, I showed the full process of selling crypto for USDT, and then sold USDT for VND to withdraw to my bank account:

The video is in Vietnamese, but you can see all the steps clearly. Especially you can see how I practice this tip by being very patient: waiting for more than 1 year just to sell a bit of it.

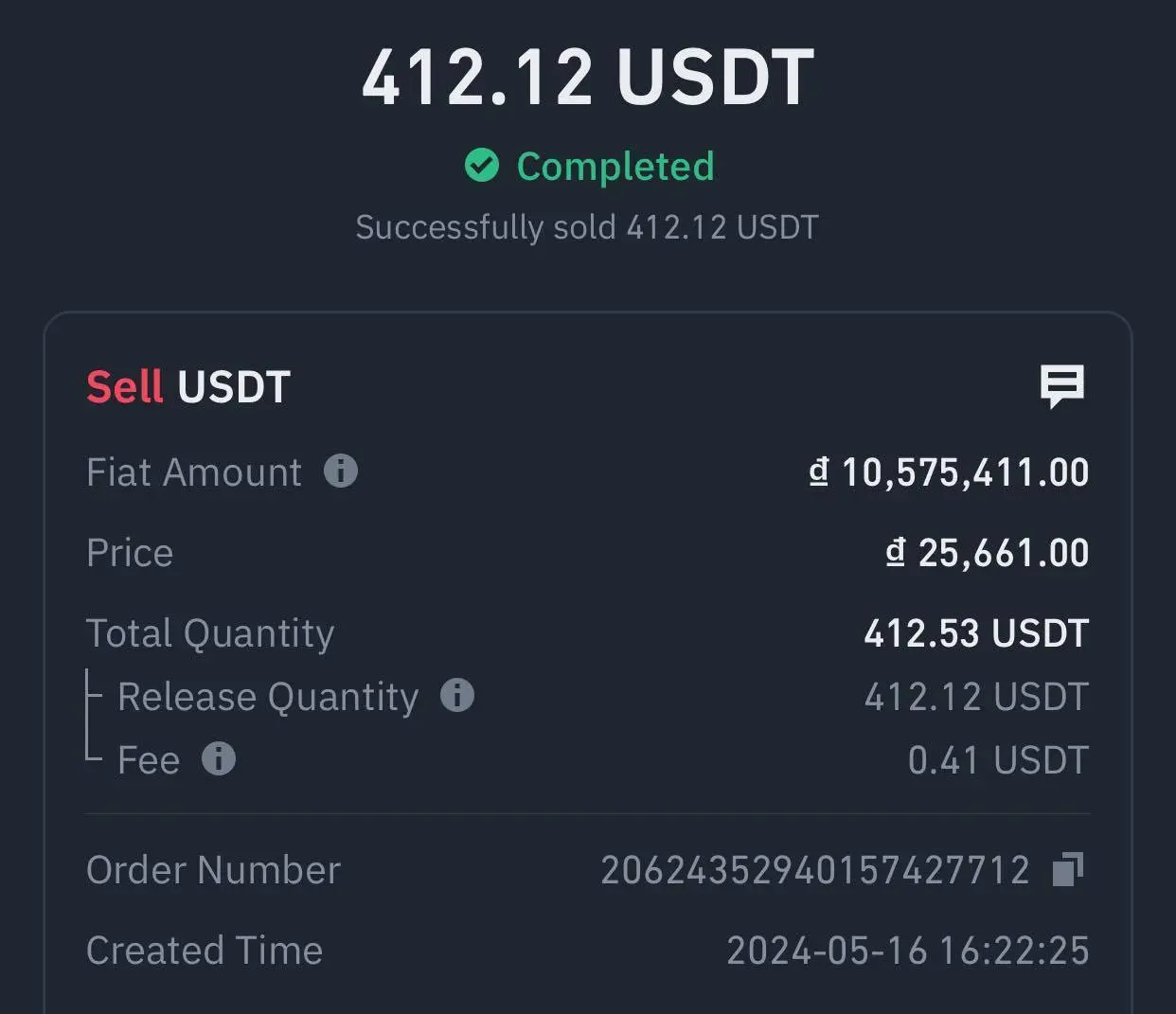

This is the proof that I sold 412.12 USDT:

If you are beginner, you can create an account on Binance and start buying crypto.

Don't Daydream of Lambos: A Long-Term Approach to Crypto Investing

The allure of cryptocurrency is undeniable. Stories of overnight millionaires and life-changing gains can be incredibly tempting, especially for beginners.

But before you dive headfirst into the world of Bitcoin and altcoins, a crucial mindset shift is necessary.

Here's the golden nugget I wish I knew when I started investing in crypto back in 2017:

Approach it with a long-term perspective, similar to how Warren Buffet approaches stock investing.

This might seem counterintuitive. After all, the crypto market is known for its volatility, with prices fluctuating wildly within short periods. It's easy to get caught up in the day-to-day frenzy, chasing quick profits by buying and selling based on short-term trends and emotions. However, statistics paint a grim picture for day traders: a study by Current Market Valuation reveals that only 1% consistently turn a profit, leaving the remaining 99% susceptible to losses.

So, why is the long-term approach so crucial for crypto? Let's unpack the philosophy behind this strategy and how it can benefit you:

The Buffet Principle: Invest Like You're Stuck

Warren Buffet's legendary quote perfectly encapsulates the essence of long-term investing:

"I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years."

This might seem like an extreme scenario, but it highlights a critical point: focus on investing in projects you believe in so strongly that even a temporary market shutdown wouldn't faze you.

This approach forces you to look beyond short-term price movements and focus on the underlying value proposition of the cryptocurrency. Are you investing in a project with a strong team, innovative technology, and real-world applications? If the answer is yes, then temporary price dips become buying opportunities, not reasons to panic-sell.

Applying the Long-Term Lens to Crypto

Here's how the "five-year shutdown" mindset translates to the crypto landscape:

- Invest Only What You Can Afford to Lose: The crypto market is inherently volatile. By only investing what you can comfortably lose, the temptation to make impulsive decisions based on fear or greed diminishes.

- Focus on the Project, Not the Price: Don't get fixated on daily price movements. Research the underlying technology, the team behind the project, and its long-term potential.

- Embrace Patience: Crypto is still a nascent asset class. Building a successful portfolio requires patience and an understanding that significant returns take time.

Benefits of the Long-Term Approach

By adopting a long-term perspective, you gain several advantages:

- Reduced Stress: The constant monitoring of charts and chasing profits can be incredibly stressful. Focusing on the long-term allows you to detach from short-term fluctuations.

- Discipline: The "five-year shutdown" mindset forces you to be more disciplined with your investments. This means resisting the urge to sell based on FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt).

- Compounding Gains: Holding your crypto allows you to benefit from the power of compounding. As the value of your investment increases over time, so do your potential returns.

Long-Term Doesn't Mean Passive

While a long-term approach is crucial, it doesn't mean complete passivity. Here are some ways to stay actively engaged in your crypto investments:

- Stay Informed: Keep up-to-date with industry trends, project developments, and regulatory changes.

- Dollar-Cost Averaging (DCA): Invest a fixed amount at regular intervals, regardless of the price. This helps average out the cost per coin over time.

- Rebalance Your Portfolio: Periodically assess your portfolio's allocation and rebalance as needed to maintain your desired risk profile.

The Final Word: Patience is Your Crypto Ally

Remember, the crypto market is a marathon, not a sprint.

By adopting a long-term perspective, prioritizing strong projects over quick gains, and maintaining discipline, you can position yourself for success in this exciting and dynamic asset class.

Don't be seduced by the allure of overnight riches – build a solid foundation and let your investments grow alongside promising blockchain technologies.

So, take a deep breath, silence the noise, and commit to a long-term crypto investment strategy. You might not own a Lambo tomorrow, but with patience and research, you can build a secure financial future fueled by the power of cryptocurrency.

Help content creators to make money online by sharing actionable marketing tips #TEDxSpeaker since 2015 ⚠ Fact: Quit 9-5 banking job after 8 years (?!)

![[Day 9] 1 Tip I Would Give Beginners Who Wanted To Get Started Investing In Crypto](https://images.unsplash.com/photo-1516245834210-c4c142787335?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDJ8fGJpdGNvaW58ZW58MHx8fHwxNzE1ODY5NzgzfDA&ixlib=rb-4.0.3&q=80&w=1024)

Comments